Northeast Community Credit Union awards the William L. Armstrong Scholarship annually to qualifying credit union members who are graduating from high school and will be attending college.

The scholarship was originally established to honor William L. Armstrong, one of the founding members of Northeast Community Credit Union who continues to serve on the Board of Directors. To qualify for the scholarship, students must be enrolled at local high schools approved by the Southern Association of Colleges and Schools, have a minimum 3.0 grade point average and plan to enter college for the following semester. As part of the selection process, students are required to submit a 500-word, typed essay on how one person can make a difference in the world.

This year the scholarships were awarded to Stevie Barnett of Cloudland High School; Brilee Culbert of Elizabethton High School; Ashley Woodby or Hampton High School; Claire Johnson of Happy Valley High School; and Sara Grubb of Unaka High School.

Students are recommended by teachers and leaders in the community. They have exemplified good citizenship in the classrooms and are active in volunteer work in the community.

Wendy Lyons, seventh and eighth grade science teacher at Hunter Elementary, is the latest Northeast  Community Credit Union Helping Teacher’s Teach grant winner.

Community Credit Union Helping Teacher’s Teach grant winner.

Lyons plans use to the Helping Teacher’s Teach grant to purchase a VEX Robotics program for Hunter Elementary students and to start a competition robotics team.

“This project introduces and enhances STEM basics for students in 7th and 8th grade,” Lyons said. “It teaches scientific approaches to the engineering design model while incorporating technology and math in complex problem-solving skills.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

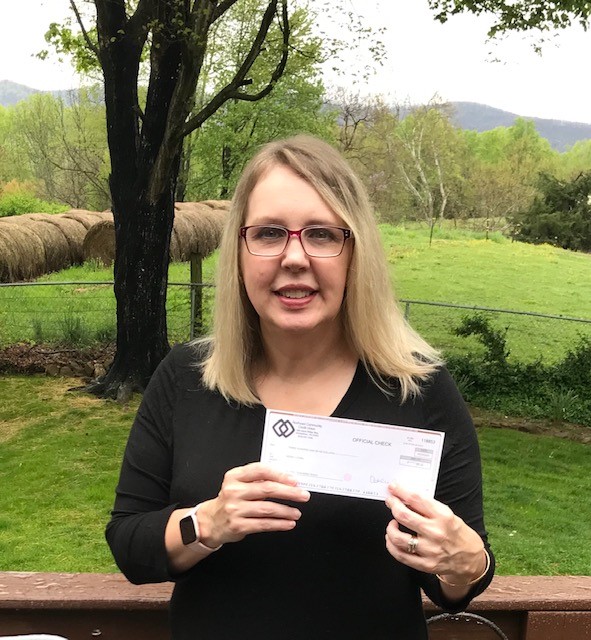

Bonnie Buckles, librarian at Central Elementary, is the latest Northeast Community Credit Union  Helping Teacher’s Teach grant winner.

Helping Teacher’s Teach grant winner.

Buckles applied for the grant to create a Literary Makerspace for Central Elementary students. The activities are set up and designed to stimulate critical thinking skills and encourage educational playfulness to follow a story plot.

“A Makerspace will allow students to become problem solvers, while working both independently and creatively,” Buckles said. “The Makerspace activities are wonderful ways to inspire interactive and engaging learning experiences.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

Robin Gilbert, special education teacher at Little Milligan Elementary, is the latest Northeast  Community Credit Union Helping Teacher’s Teach grant winner.

Community Credit Union Helping Teacher’s Teach grant winner.

Gilbert applied for the Helping Teacher’s Teach grant to start a music enrichment program for the K-8 students at Little Milligan. A parent volunteer provides music instruction. The school has a small assortment of instruments for the students to use, including guitars, drums, and one flute.

Items needed for the program are music stands, recorders and left-handed guitars. Gilbert said Little Milligan will hold fundraisers to purchase items not covered by the Helping Teachers Teach grant.

“Music is a universal language,” Gilbert said. “Music has been found to improve brain function and increase learning ability. Furthermore, music will allow our students a social creative outlet for social-emotional stresses.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

Have you heard about IRS Imposter Scams?

Here’s how they work:

You get a call from someone who says she’s from the IRS. She says that you owe back taxes. She threatens to sue you, arrest or deport you, or revoke your license if you don’t pay right away. She tells you to put money on a prepaid debit card and give her the card numbers.

The caller may know some of your Social Security number. And your called ID might show a Washington, DC area code. But is it really the IRS calling?

No. The real IRS won’t ask you to pay with prepaid debit cards or wire transfers. They also won’t ask for a credit card over the phone. And when the IRS first contacts you about unpaid taxes, they do it by mail, not by phone. And caller IDs can be faked.

Here’s what you can do:

- Stop. Don’t wire money or pay with a prepaid debit card. Once you send it, the money is gone. If you have tax questions, go to irs.gov or call the IRS at 800-829-1040.

- Pass this information on to a friend. You may not have gotten one of these calls, but the chances are you know someone who has.

Please report scams.

If you spot a scam, please report it to the Federal Trade Commission.

- Call the FTC at 1-877-FTC-HELP (1-877-382-4357) or TTY 1-866-653-4261

- Go online: ftc.gov/complaint

Your complaint can help protect other people. By filing a complaint, you can help the FTC’s investigators identify the imposters and stop them before they can get someone’s hard-earned money. It really makes a difference.

Want to know more? Sign up for scam alerts at ftc.gov/subscribe

Northeast Community Credit Union recently donated $500 to the Shepherd’s Inn.

The Shepherd’s Inn is Carter County’s only safe house and emergency shelter for women and their children who are seeking shelter from domestic violence or temporary homelessness.

The Shepherd’s Inn began providing emergency shelter to women and children in 1997. Since then, thousands of clients have received confidential emergency shelter, meals and other forms of aid.

Donations to Shepherd’s Inn can be made by mail to P.O. Box 2214, Elizabethton, TN 37644 or by contacting Shepherd’s Inn at (423) 542-1080.

Northeast Community Credit Union has been serving the community since October 1952 when it was chartered as a credit union by the State of Tennessee. Northeast Community Credit Union is a not-for-profit financial cooperative. It is open to anyone who lives, works, worships or attends school in Carter, Johnson, Washington, Unicoi and Sullivan counties along with their immediate family members.

Northeast Community Credit Union presented a $500 donation to the United Way of  Elizabethton/Carter County and Johnson County as part of their annual partnership with the non-profit agency.

Elizabethton/Carter County and Johnson County as part of their annual partnership with the non-profit agency.

The United Way relies on community donations to provide assistance to thousands of individuals through partnerships with other non-profit community organizations.

These partnerships include Boys and Girls Club of Elizabethton/Carter County, Assistance and Resources Ministries, Elizabethton Senior Citizens Center, 211 Contact Ministries, Adult Day Services, American Red Cross, Elizabethton Neighborhood Service Center, Personal Support Services, and the Boy Scouts Sequoyah Council.

United Way Director Crystal Carter said it was community efforts that kept the United Way campaign on track. NCCU’s donation will be used to help fund literacy projects sponsored by the Boys and Girls Club of Elizabethton/Carter County in the United Way of Elizabethton/Carter County and Johnson County service area.

To donate to United Way or for more information, call 423-543-6975 or email, director@uwayecc.org

Northeast Community Credit Union has been serving the community since October 1952 when it was chartered as a credit union by the State of Tennessee. Northeast Community Credit Union is a not-for-profit financial cooperative. It is open to anyone who lives, works, worships or attends school in Carter, Johnson, Washington, Unicoi and Sullivan counties along with their immediate family members.

Northeast Community Credit Union’s Board of Directors includes the Elizabethton/Carter County  Animal Shelter in their community sponsorship efforts. NCCU Electronic Services Manager Regina Chambers recently presented a $500 donation as part of the annual partnership to ECCAS Director Shannon Posada.

Animal Shelter in their community sponsorship efforts. NCCU Electronic Services Manager Regina Chambers recently presented a $500 donation as part of the annual partnership to ECCAS Director Shannon Posada.

Posada said the donation will be used to cover the day-to-day expenses at the animal shelter – including pet adoption sponsorships, pet and cleaning supplies, medical care, food and toys for the pets and more.

NCCU also serves as a donation drop-off point for supplies for the Elizabethton/Carter County Animal Shelter. Donation boxes for pet food and supplies can be found at all four Northeast Community Credit Union locations.

Northeast Community Credit Union has been serving the community since October 1952 when it was chartered as a credit union by the State of Tennessee. Northeast Community Credit Union is a not-for-profit financial cooperative. It is open to anyone who lives, works, worships or attends school in Carter, Johnson, Washington, Unicoi and Sullivan counties along with their immediate family members.

Katarina Finney, fifth grade teacher at Mountain City Elementary, is the latest Northeast Community  Credit Union Helping Teacher’s Teach winner.

Credit Union Helping Teacher’s Teach winner.

Finney applied for the Helping Teachers Teach grant to help promote fifth-grade science. The award will be split between STEM activities for classes, new flexible seating options and literature promoting science education.

“This project will enhance the learning experience of my students by making science more engaging and hands-on,” Finney said. “I believe it will promote higher student motivation and better work quality.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union.