Northeast Community Credit Union’s Board of Directors includes Recovery Soldiers Ministries in their  community sponsorship efforts. NCCU Community Engagement Director Kathy Campbell recently presented a $500 donation as part of the annual partnership to Recovery Soldiers Ministries Program Director Ben Cole.

community sponsorship efforts. NCCU Community Engagement Director Kathy Campbell recently presented a $500 donation as part of the annual partnership to Recovery Soldiers Ministries Program Director Ben Cole.

“Recovery Soldiers Ministries provides a tremendous service to our community,” Campbell said. “We want to support them as they continue to help those in need. We are all about sharing, caring, and giving back in our communities. That’s the real credit union difference.”

Recovery Soldiers Ministries is a faith-based recovery program to help individuals overcome addiction. Students in the program live on campus for a structured year-long inpatient program. Currently, Cole said approximately 30 people are registered in the program. NCCU’s sponsorship will help to defray the cost of operating the recovery program.

“This is going to change lives,” Cole said. “It is a God-send, a real blessing. There are tremendous expenses that go into running a recovery program. Northeast Community Credit Union’s donation will help us continue to meet day-to-day needs.”

Along with the inpatient program, Recovery Soldiers Ministries has outpatient sessions to deal with struggles in all areas of life and conducts weekly worship services led by Cole and RSM President Josh Scalf. The ministry also has a thrift store to help support their programs.

Northeast Community Credit Union has been serving the community since October 1952 when it was chartered as a credit union by the State of Tennessee. Northeast Community Credit Union is a not-for-profit financial cooperative. It is open to anyone who lives, works, worships or attends school in Carter, Johnson, Washington, Unicoi and Sullivan counties along with their immediate family members.

For more information on Recovery Soldiers Ministries visit https://recoverysoldiersministries.org.

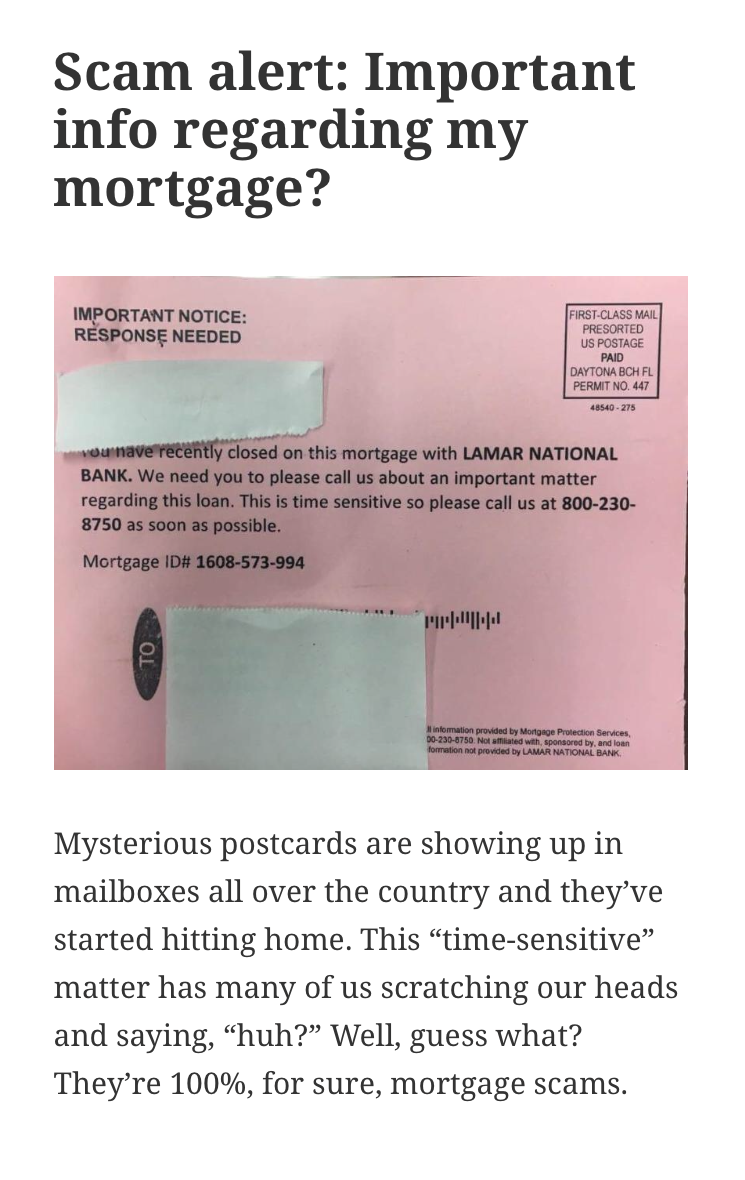

information on your mortgage. These are a scam. If you receive one of these postcards, you do not need to call the 1-800 number on the card and you do not need to take any further action. Simply throw the card away.

information on your mortgage. These are a scam. If you receive one of these postcards, you do not need to call the 1-800 number on the card and you do not need to take any further action. Simply throw the card away.

Center’s Magic Movement Program.

Center’s Magic Movement Program.

Elizabethton.

Elizabethton.

Kate Theater.

Kate Theater.

Credit Union Helping Teacher’s Teach winner.

Credit Union Helping Teacher’s Teach winner.