Northeast Community Credit Union is proudly sponsoring a ‘Meet & Greet’ event for the 2023 State Champion Hampton Bulldogs Basketball team. Bulldog fans are invited to join us on April 12 from 3 pm until 5 pm at our main office at 980 Jason Witten Way in Elizabethton. Also invited are members of the 1960 Hampton State Championship team. Come for an enjoyable afternoon of autographs, photos, and light refreshments.

Nick Colbaugh, 4th through 6th grade teacher for Carter County Online Academy, is the latest Northeast Community Credit Union Helping Teachers Teach grant winner.

Community Credit Union Helping Teachers Teach grant winner.

Colbaugh applied for the Helping Teachers Teach to help purchase headphones for students and help with remote learning projects. Carter County Online Academy is an online/remote learning option for Carter County students in 4th through 12th grade.

“With headphones our students can zone out background noise during Google Meets and everyday learning activities,” Colbaugh said. “Also, remote learning opportunities help get our virtual students out into the real world where they can communicate face-to-face with classmates and teachers. Furthermore, it gives students hands-on experience with standards that have been taught throughout the year.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members online or at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

Northeast Community Credit Union is investing in the children of Carter County with a donation of $1,000 to the Carter County Imagination Library.

$1,000 to the Carter County Imagination Library.

Northeast Community Credit Union is a Foundation Member of CCIL and has contributed $1,000 each year since the start of Carter County Imagination Library. Carter County Imagination Library provides a free book to children in Carter County every month from birth until they turn five years old.

“Our Board of Directors has made a commitment to our community to annually donate a percentage of proceeds to local organizations and worthwhile causes,” NCCU President/CEO Teresa Arnold said. “We are so thankful to help provide books to children in our county. Children can encounter worlds of adventure and inspiration while learning what great treasures books can be – such a gift.”

According to the CCIL, the cost to provide children with books from birth until age 5 is around $150 per child. Presenting this year’s donation on behalf of NCCU to Carter County Imagination Library is Nikki Garland, Loans and Member Resolutions.

To donate to the Imagination Library, contact the Elizabethton/Carter County Public Library at (423) 547-6360.

Northeast Community Credit Union is a major contributor in the local community and has been providing service since October 1952 when it was chartered as a credit union by the State of Tennessee. Northeast Community Credit Union is a not-for-profit financial cooperative focused on youth financial education, helping families have richer futures, and growing strong local businesses while serving anyone who lives, works, worships or attends school in Carter, Johnson, Washington, Unicoi and Sullivan counties along with their immediate family members.

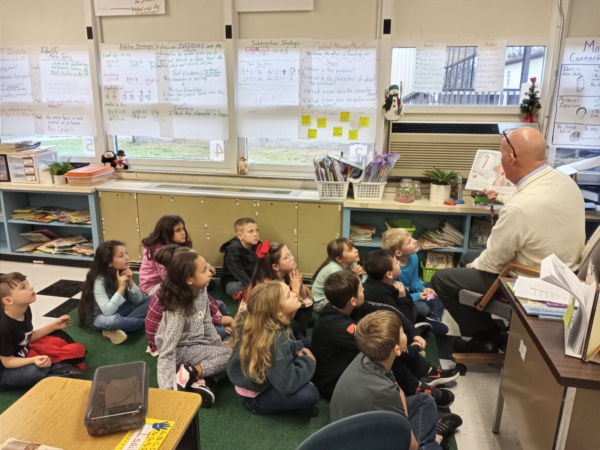

Melinda Hill, second grade teacher at Keenburg Elementary, is the latest Northeast Community Credit

Keenburg Elementary Principal Doug Mitchell reads to Melinda Hill’s classroom.

Union Helping Teachers Teach grant winner.

Hill applied for the Helping Teachers Teach to purchase new, appropriate child-sized seating for her classroom.

“The current seating is various sizes, and with some issues,” Hill said. “Chairs are an extremely hard, thick plastic that does not allow for comfortable seating. The new chairs will allow the students to sit properly using good posture, and this will aid in learning because they will be comfortable. The chairs should last for many years, allowing many students to benefit.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members online or at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

Chris Cook, music teacher at Unaka Elementary, is the latest Northeast Community Credit Union  Helping Teachers Teach grant winner.

Helping Teachers Teach grant winner.

Cook applied for the Helping Teachers Teach to purchase musical instruments, specifically recorders, for her fourth- and fifth-grade students. Because of current safety protocols, each student is required to have his/her own instrument.

“Learning how to play a recorder with other classmates develops teamwork, discipline and musical skills such as reading notes on the staff and counting rhythms,” Cook said. “Students then have the option to build on their skills with the high school band, both after school and during music classes. Just like learning to ride a bike, playing a musical instrument is a lifetime skill and source of enjoyment.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members online or at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.

Northeast Community Credit Union is helping sponsor the TLC Community Center’s Christmas ‘Bundles of Love’ program.

of Love’ program.

The Bundles of Love program collects items for children in need in the local community; such as hygiene items, school supplies, personal items and small toys. The bundles are distributed based on referrals from local schools and to clients who participate in the TLC Summer Food program.

NCCU donated 1,500 bags to the TLC Community Center to use for the program and will be providing volunteers for the distribution of the gifts. NCCU will also serve as a drop-off location for items for the Bundles of Love.

“Our credit union works hard to help improve the lives of our neighbors –financially and otherwise,” NCCU President/CEO Teresa Arnold said. “There are needs right here where we live, and we’re so pleased to work with TLC Community Center to help wherever we can.”

“There are so many families missing basic essentials in our community,” TLC Director Angie Odom said. “This is about meeting needs in our own hometown.”

NCCU’s Main Office (behind Elizabethton High School) and their Roan Mountain Office will be accepting items for the Bundles of Love, which include shampoo, toothpaste, individually packaged toothbrushes, dental floss, deodorant, soaps, combs, body wash, washcloths, pencils, erasers, notebooks, crayons, socks, gloves, hats, mittens, small toys and other similar items.

The Bundles of Love will be distributed in December to boys and girls aged from toddler to teenager.

Items for the Bundles of Love can be dropped off at either the NCCU Main Office at 980 Jason Witten Way, Elizabethton, or at the NCCU Roan Mountain office at 8301 Highway 19E, in Roan Mountain.

Kathi Hill, fifth grade teacher at Valley Forge Elementary, is the latest Northeast Community Credit Union Helping Teachers Teach grant winner.

Union Helping Teachers Teach grant winner.

Hill applied for the Helping Teachers Teach to purchase the study.com program for her students. Study.com is an interactive video series that allows students to immerse themselves in short, engaging lessons that are produced to Tennessee education standards.

“These lessons would assist me in planning as well as bringing history to life for my students,” Hill said. “It would be an excellent supplement to our textbook.”

Northeast Community Credit Union awards $300 every month to a classroom to be utilized for classroom needs, classroom activities, and academic enrichment. Helping Teachers Teach is open to teachers within Carter, Johnson, Unicoi, Sullivan and Washington counties who are members of Northeast Community Credit Union. Area teachers may become members online or at any NCCU location and can download the grant application on the credit union’s website: www.BeMyCU.org.