Northeast Community Credit Union is excited to announce the appointment of David LeVeau as Commercial Loan Manager, spearheading the credit union’s new commercial lending program. Since Mr. LeVeau’s arrival, NCCU has instituted a comprehensive commercial lending initiative to support local businesses with their financing requirements.

Commercial Loan Manager, spearheading the credit union’s new commercial lending program. Since Mr. LeVeau’s arrival, NCCU has instituted a comprehensive commercial lending initiative to support local businesses with their financing requirements.

Bringing 23 years of financial expertise from the community banking sector and beyond, Mr. LeVeau holds a BS degree in Business Administration from UNC-Chapel Hill, a Masters of Accountancy from ETSU, and graduated from the LSU Graduate School of Banking in 2019. Beyond his professional accomplishments, Mr. LeVeau is actively involved in the community, serving on several non-profit boards and coaching youth sports. Married for nearly 13 years to his wife Anette, Mr. LeVeau enjoys spending quality time with his children and grandchildren.

Teresa Arnold, President/CEO of NCCU, praises LeVeau as “an ideal addition to our credit union,” highlighting his extensive financial background, dedication to family financial well-being, and hands-on involvement in community growth. Arnold emphasizes the growing demand for commercial lending among local small businesses and sees LeVeau’s expertise as instrumental in helping businesses achieve sustained success.

Founded in 1952, NCCU’s assets have reached nearly $180 million, serving close to 13,000 members. Membership is open to individuals and businesses residing, working, worshiping, or attending school in Carter, Johnson, Washington, Unicoi, and Sullivan counties, along with their families. With four branches and digital services, NCCU caters to various member needs.

The new lending program extends commercial real estate loans, business equipment and vehicle loans, and business lines of credit to business members. Mr. LeVeau is dedicated to assisting existing and potential business members in the community. These offerings align with NCCU’s mission of “people helping people,” aiming to enhance local financial well-being and promote economic development.

Businesses in Carter, Johnson, Sullivan, Washington, and Unicoi counties can become NCCU members by depositing a single “share” ($5), granting ownership in the credit union and eligibility for loan products, checking accounts, investments, and more. For additional details on the program or membership, visit www.bemycu.org. NCCU’s commercial loan webpage is accessible at https://www.bemycu.org/loans/loan-types/commercial-loans/. Contact David LeVeau at commerciallending@bemycu.org for inquiries.

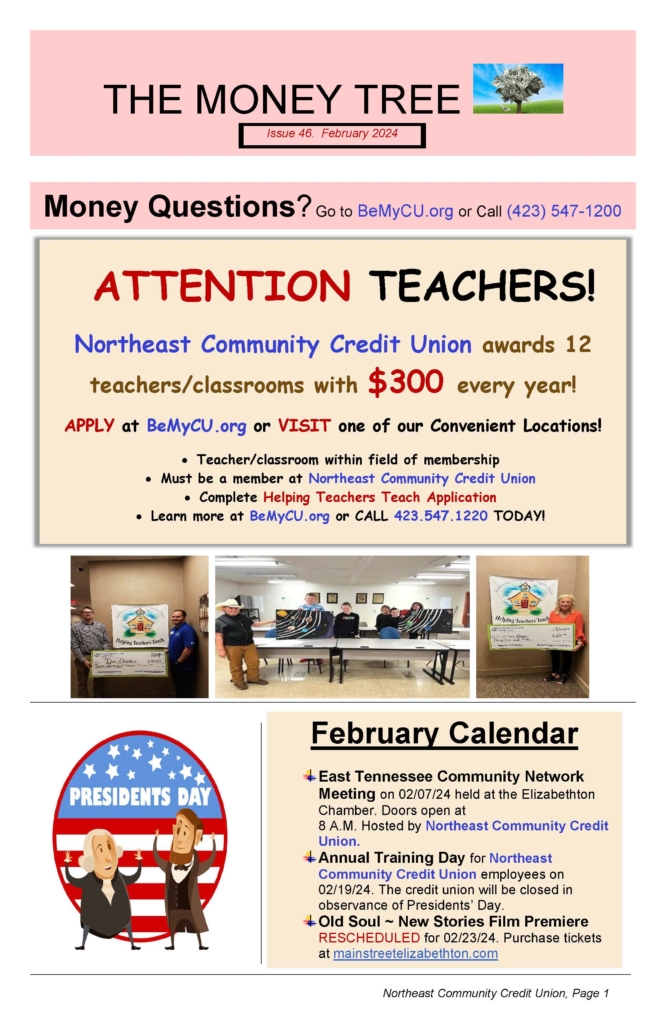

Credit Union Helping Teachers Teach grant winner.

Credit Union Helping Teachers Teach grant winner.

Union Helping Teachers Teach grant winner.

Union Helping Teachers Teach grant winner. Commercial Loan Manager, spearheading the credit union’s new commercial lending program. Since Mr. LeVeau’s arrival, NCCU has instituted a comprehensive commercial lending initiative to support local businesses with their financing requirements.

Commercial Loan Manager, spearheading the credit union’s new commercial lending program. Since Mr. LeVeau’s arrival, NCCU has instituted a comprehensive commercial lending initiative to support local businesses with their financing requirements.

Northeast Community Credit Union Helping Teachers Teach grant winner.

Northeast Community Credit Union Helping Teachers Teach grant winner. $1,000 to the Carter County Imagination Library.

$1,000 to the Carter County Imagination Library.

Helping Teachers Teach grant winner.

Helping Teachers Teach grant winner.