Certificates of deposit lock up your money for a set period. In return, you earn higher interest than what’s available on most savings accounts.

What Is a Traditional CD?

A traditional CD or certificate of deposit is a type of savings account. They can also be called time deposits, fixed deposits or term deposits.

Unlike a traditional savings account that lets you withdraw money from at any time, a CD has a fixed term and:

- Requires a minimum deposit amount that is higher than a savings account.

- Allows you to withdraw money at the end of the term, or maturity date. Earlier withdrawals can be made only by paying a penalty.

- Don’t let you add money after your initial deposit unless it is a special type of CD, like our Nest Egg CD.

In other words, by opening the CD, you agree to leave your one-time deposit in the account for a fixed amount of time. In an emergency, you can withdraw funds early, but you will pay a penalty to do so. In exchange for agreeing to a set term length, you get a fixed interest rate, typically one higher than a traditional savings account. The longer the term length, the higher the interest rate you earn.

How do CDs work?

A traditional CD is essentially a time-bound deposit. A CD, also called a “share certificate” at credit unions, almost always earns more interest than a regular savings account. Banks and credit unions pay extra for the right to hold a lump sum for a period of months or years, known as the CD’s “term.”

The credit union rewards you by paying you a higher interest rate than it does for a savings account or money market account. You make a higher annual percentage yield (APR) on the money you deposit in the CD. Some CDs compound interest daily. The credit union pays more to you because you’re giving them money for a longer period of time. They then can use your money to earn more money. For example by extending other customers long-term like loans.

The National Credit Union Association insures your CD up to $250,000, just as with any deposit account. So the only risk to you is the penalty you’d have to pay if you withdrew the money before the CD term was up.

Some CDs allow you to choose to take the monthly interest earned out. Others require you cash out the CD only at the end of the term length.

When opening a CD, you choose how long you want to give our money to the bank, known as the term length. Common term lengths for traditional CDs include 6, 12, 18, 24 and 30 months and 3, 4, 5 and 6 years. Some banks and credit unions will also offer a custom term length.

As a rule, the longer the term, the higher the interest rate. Putting more money into your CD can also boost your annual percentage yield, the effective return on your deposit that comes from compounding the interest over the course of a year.

You’ll earn interest on the deposit until it matures, at which point you can collect the full amount. But if you need funds in a CD before the maturity date, there’s generally a penalty.

When should I get a certificate of deposit?

CDs work best for savers who have the financial breathing room to sock away money for years at a time. You’ll also need to be able to meet any minimum deposit requirements, typically $500 or $1,000.

But you might consider short-term CDs too, especially if you want to take advantage of high rates now.

When deciding on a deposit amount and a term length, consider your other financial commitments and your time horizon. Make sure you’ve already banked enough emergency savings — ideally three to six months’ worth of living expenses that you can access easily in time of need. By contrast, any money you put into a CD will be locked down until the end of the term; withdrawing it ahead of time means you’ll pay a penalty.

Considerations Before You Open a CD

By now, you are probably thinking of opening a CD with the longest term possible. But having a very long-term may not be the best thing to do. For example, you may need your money before the time period is up and if you choose to remove your money before that happens, you can be penalized by the bank or credit union. Some don’t allow you to make partial withdrawals and require you withdraw the full account balance. When you do, you can put two or more months of interest.

Bottom line, before you invest in a CD, either make sure you’re confident that you won’t need the money before the maturity date or that you’re comfortable paying a penalty if you need the money earlier. If you’re not sure, consider choosing a savings account or money market instead.

When Your CD Matures

When your CD reaches the end of its term, it matures. Toward the end of your term, your credit union will inform you about its impending maturity and present you with options, including taking your money and walking away or renewing for another term length.

Are CDs Safe?

CDs are as just as safe as the money you have in your savings or checking account with the bank, assuming none of those accounts—or the combination of accounts owned by you at the same bank—has more than the insured maximum of $250,000. With NCUA insurance, you’re guaranteed to get your money back—up to the insured maximum—if your credit union goes under for any reason.

CDs and Your Credit

CDs in themselves won’t help you build your credit history. However, some financial institutions offer a CD secured loan if you open a CD. This is a loan that uses your CD deposit as collateral. If you default on your loan payments, your CD will be taken to pay the loan. Making timely payments on the loan can help you build your credit, if your bank or credit union reports your payments to all three credit bureaus. Not all do, so if you chose this path as a way to build credit, ask your credit union. The CD itself won’t impact your credit one way or another.

Street Elizabethton are excited to announce a fun, interactive, and safe opportunity to capture the magic of Christmas downtown. From December 6 – 16, community members are invited to submit photos using #DowntownElizabethtonChristmas on Facebook and Instagram.

Street Elizabethton are excited to announce a fun, interactive, and safe opportunity to capture the magic of Christmas downtown. From December 6 – 16, community members are invited to submit photos using #DowntownElizabethtonChristmas on Facebook and Instagram.

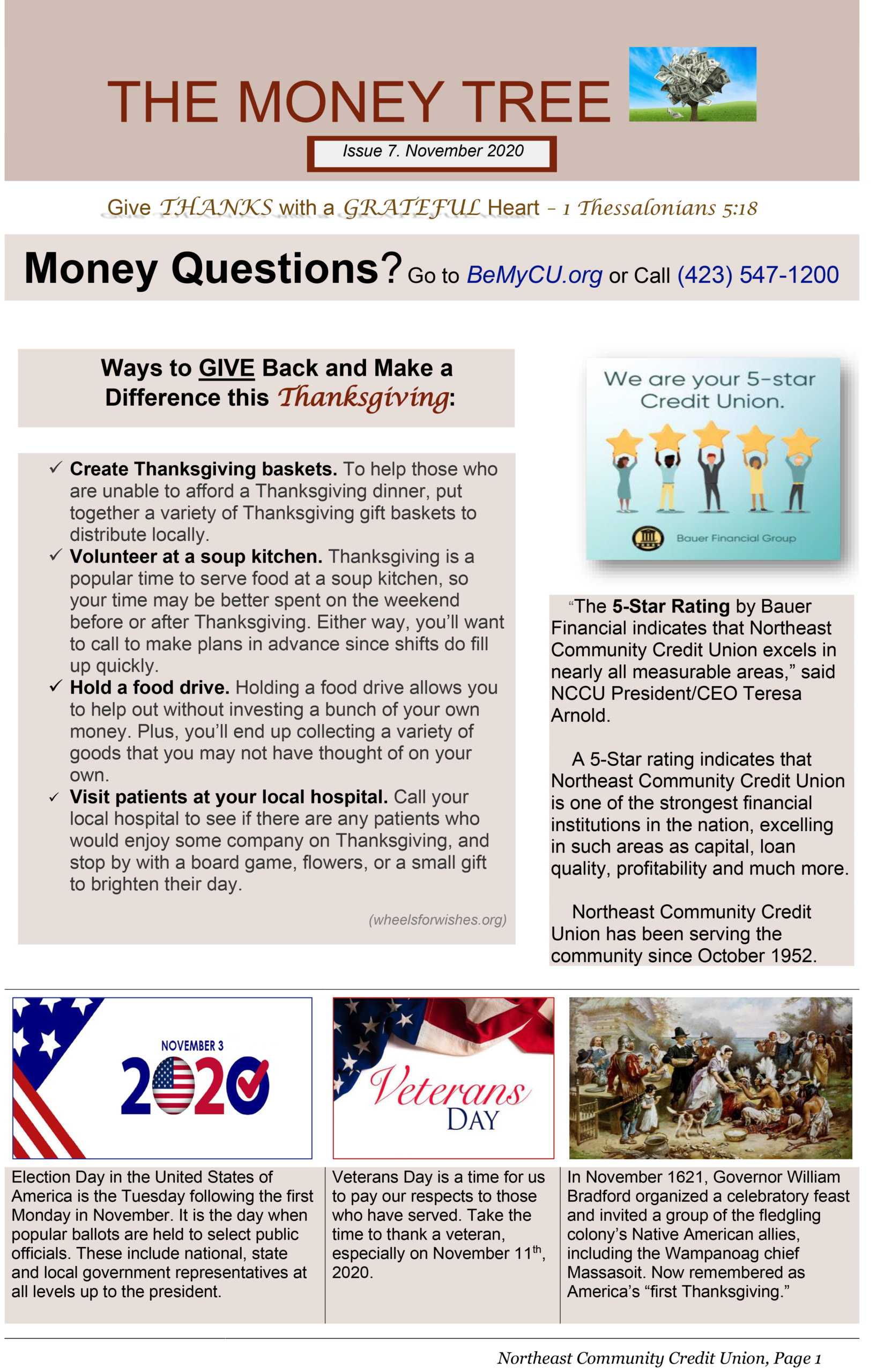

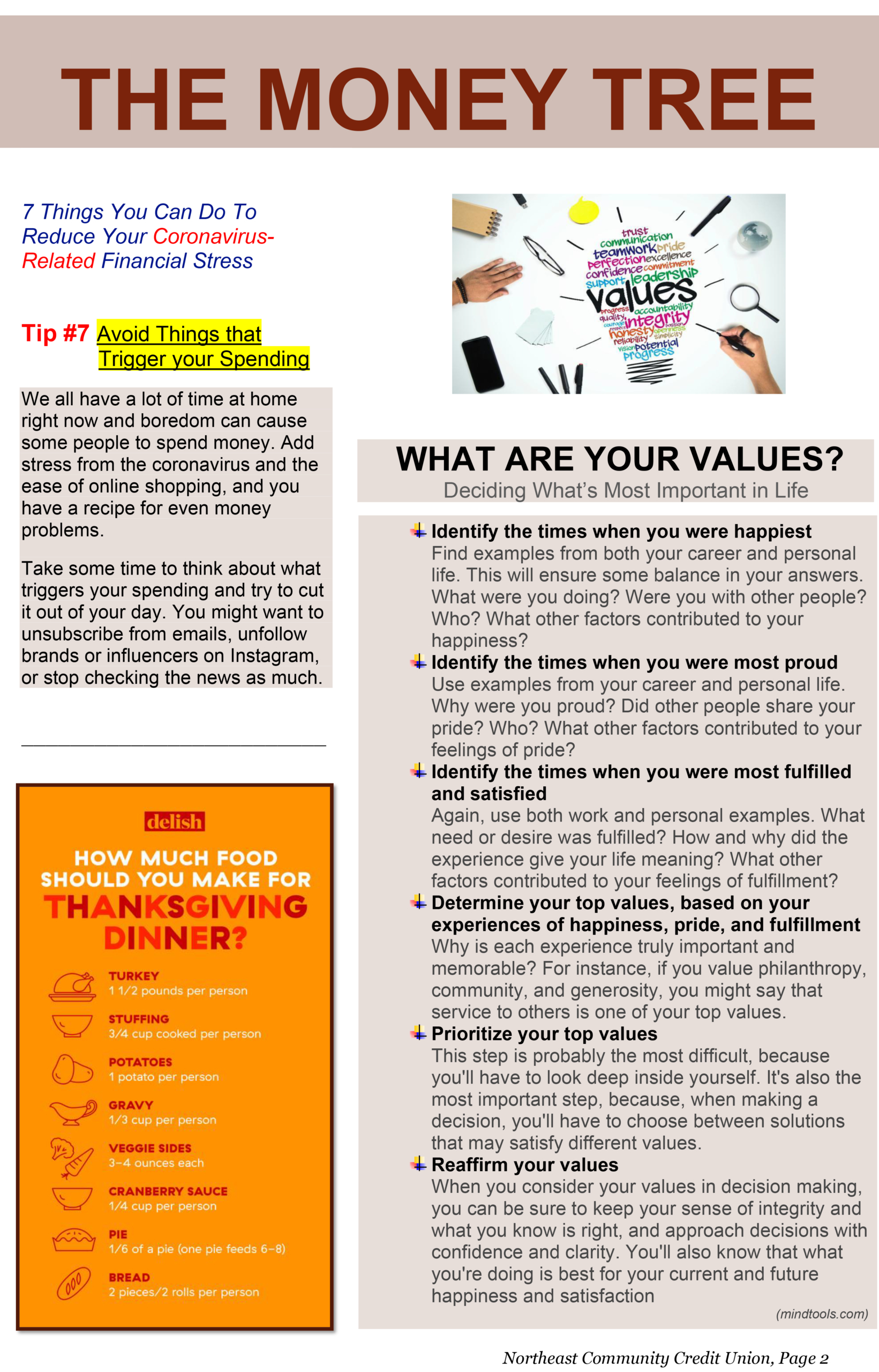

Northeast Community Credit Union Helping Teacher’s Teach grant winner.

Northeast Community Credit Union Helping Teacher’s Teach grant winner.

Report.”

Report.”

and Elizabethton City school systems. Bags were delivered to all staff at each school in both school systems.

and Elizabethton City school systems. Bags were delivered to all staff at each school in both school systems.

employees.

employees. supplies. Applications can be found online at

supplies. Applications can be found online at

Project.

Project. by sponsoring both of Carter County’s backpack programs.

by sponsoring both of Carter County’s backpack programs.